Countries:

Brazil

Status:

Completed

Sector:

Finance

The project worked to mainstream climate risk assessment in credit operations of Brazilian Development Banks and developed an Inclusive Climate Neutrality Strategy for BNDES.

Finance is an essential component to a just, resilient and sustainable low-carbon transition. Particularly in Brazil, Development Banks (DBs) play a major role in supporting long-term structural economic growth and development, representing a major piece of the total credit provided for the last 60 years. DBs are key stakeholders in the climate action landscape as they can accelerate and support the move to net-zero economic sectors in Brazil, leveraging opportunities aligned with Paris Agreement ambitions.

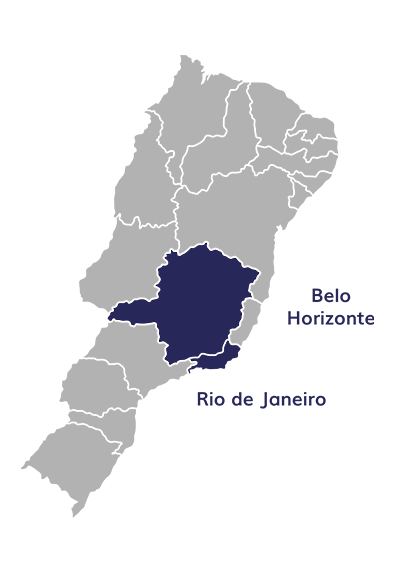

Two key DBs were supported through this project to mainstream climate risk assessments: Banco de Desenvolvimento de Minas Gerais (BDMG) and Banco Nacional de Desenvolvimento Econômico e Social (BNDES).

A deep dive analysis of documents, policies and reports from both main counterpart banks was conducted to identify their maturity and current practices in terms of climate risk assessments – and their contributions to a net-zero economy transition.

Phase one of the project focused on evaluating climate change impacts on credit risk operations, providing tools and recommendations for DBs to integrate climate risks into their portfolios.

Phase two aimed to support BNDES in its carbon project selection process to purchase carbon credit, as well as designing its Inclusive Climate Neutrality Strategy. The design of the Neutrality Strategy was ambitious, integrating 'just transition' aspects in the decarbonisation and climate strategy of BNDES – the largest DB in Brazil and one of the largest DBs worldwide.

This project was delivered in partnership with 2Degrees Investing Initiative.

"Given the innovative nature of the topic, WayCarbon's support was fundamental in preparing and supporting the teams throughout the process. The experience and knowledge provided on the carbon market and on the process of analysing projects and acquiring carbon credits allowed accelerating the learning curve of the internal team and ensuring greater security in decision-making."

Christina Mendonça

Analyst at the Capital Markets Area, BNDES

"The integration between credit and climate risk is still quite complex. The [climate risk assessment] tool will help us to integrate socio-environmental events and financial losses, and with it, we will validate a new process that measures this correlation."

Wu Yong Lei

Manager of the Credit Risk Division, BNDES

"The topic is challenging, and we believe that the [climate risk assessment] tool can bring us – based on the classification of climate risks – an integration in the ratings that we use to evaluate the granting of credit."

Mariana Paula Pereira

Analyst at the Risk and Socioenvironmental Responsibility team, BDMG

A climate risk assessment framework for credit operations and a tool were developed for all DBs in Latin America

to support the use of the tool for other DBs, including case studies and complementary resources

developed for BNDES to build internal capacity to assess the quality of the credits and projects it receives

developed in collaboration with BNDES to guide their transition to net zero, incorporating a 'just transition' perspective

In the first phase of the project, a climate risk assessment framework for credit operations and a tool for climate risk assessment was made available for all DBs in Latin America (in Portuguese, English and Spanish) through the ESG Academy platform. This was joined by an intensive course on how to use the materials produced by the project and other relevant information, such as case studies, complementary resources/materials, etc.

Employees from DBs and agencies in Latin America can subscribe to the course. The strong interest received for this course shows the project's success in engaging with the Brazilian financial sector to empower Brazilian DBs with knowledge, methods, and tools to support the promotion of a greener, low-carbon and resilient future.

The second phase of the project assisted BNDES to establish eligibility criteria for carbon projects. As national legislation points to an increasingly regulated market, it was important for BNDES to build their internal capacity to assess the quality of the credits and projects it receives. Finally, the project supported BNDES to develop an Inclusive Climate Neutrality Strategy, involving topics like financed emissions and decarbonisation, establishment of Science-Based Targets for financial institutions, adaptation, engagement and stewardship, and integration with a 'just transition' perspective. BNDES publicly committed to the Inclusive Climate Neutrality Strategy during a presentation at COP27.

GESI challenges and opportunities for each of the analysed sectors were integrated into the framework

GESI criteria were included in the eligibility checking protocol, enabling the screening of potential projects through a diversity and inclusion lens

A 'just transition' perspective was integrated into the strategy to support the application of a social inclusion lens in BNDES’s investment processes and decisions

The inclusion of GESI aspects in BNDES’s strategy will incentivise other DBs to increase the promotion of inclusive practices in their operations

Limited access to green finance from marginalised groups and lack of awareness from financial systems are significant barriers to a green and just transition. WayCarbon aimed to address these challenges by embedding gender equality and social inclusion (GESI) considerations across all aspects of the project.

The “Climate risk assessment framework” include a review of GESI related issues associated with each sector assessed in the climate risk assessment tool. This included specific challenges and opportunities to further develop and integrate GESI elements in climate risk assessments and enhance capabilities in DBs.

The design of the carbon projects' eligibility criteria for BNDES’ purchase processes integrated GESI aspects at the evaluation stage. This enabled the screening of potential projects through a diversity and inclusion lens and provided recommendations to companies on integrating diversity into their operations and supply chains.

The development of the Climate Neutrality Strategy for BNDES explored the integration of diversity and social inclusion insights into investment processes as part of a just transition. Research has linked gender diversity in leadership and the workforce to financial returns, lower risk, and sustainable growth. Therefore, the application of a social inclusion lens to investment processes can enhance the positive impacts that a more diverse and social inclusive project might have on vulnerable/marginalised groups.

Meetings held with members from BDMG, BNDES, other DBs and agencies, and project stakeholders included key discussions on GESI aspects. The participants expressed appreciation that integrated GESI was being considered in the work, as integrating such aspects is recognised as a significant challenge for the institutions.

These are the next steps and recommendations for the continuity and sustainability of this work:

Training in the use of the climate risk assessment tool for credit operations at Development Banks

Visit websiteA deep dive analysis of the GESI aspects of the project, including key recommendation and lessons

View PDFBNDES’s Climate and Development plan, developed with technical support from WayCarbon and UK PACT

View PDFUK PACT (Partnering for Accelerated Climate Transitions) is a unique capacity-building programme. Jointly governed and funded by the UK Government’s Foreign, Commonwealth and Development Office (FCDO) and the Department for Energy Security and Net Zero (DESNZ) through the UK's International Climate Finance, it works in partnership with countries with high emissions reduction potential to support them to implement and increase their ambitions for tackling climate change.

© Copyright 2025 UK PACT Privacy Notice Cookie Policy